Transnet Rail Challenges: Insights into South Africa’s Future

Transnet’s rail division faced significant challenges in 2024, with volumes down 18.4%. Learn how they’re fighting back with strategic initiatives and restructuring to improve *Transnet locomotive* performance!

“`html

Introduction

In May 2024, Transnet SOC Ltd. announced its financial results for the year ending March 31, 2024. The state-owned freight and logistics company reported significant financial challenges and operational underperformance, particularly in its rail division. The financial year saw a decline in the volume of goods transported, impacting revenue and profitability across various segments.

Financial Performance Overview

Transnet reported a decrease in revenue to R61.7 billion for the fiscal year ending March 31, 2024, compared to R67.0 billion in the previous year. This 8% decrease was primarily due to lower volumes transported across multiple freight segments. The company’s earnings before interest, tax, depreciation, and amortization (EBITDA) also decreased, falling to R18.5 billion from R24.4 billion the prior year. Transnet recorded a net loss of R5.7 billion, a considerable downturn from the previous year’s loss of R5.7 billion. The group’s total debt increased to R130.1 billion.

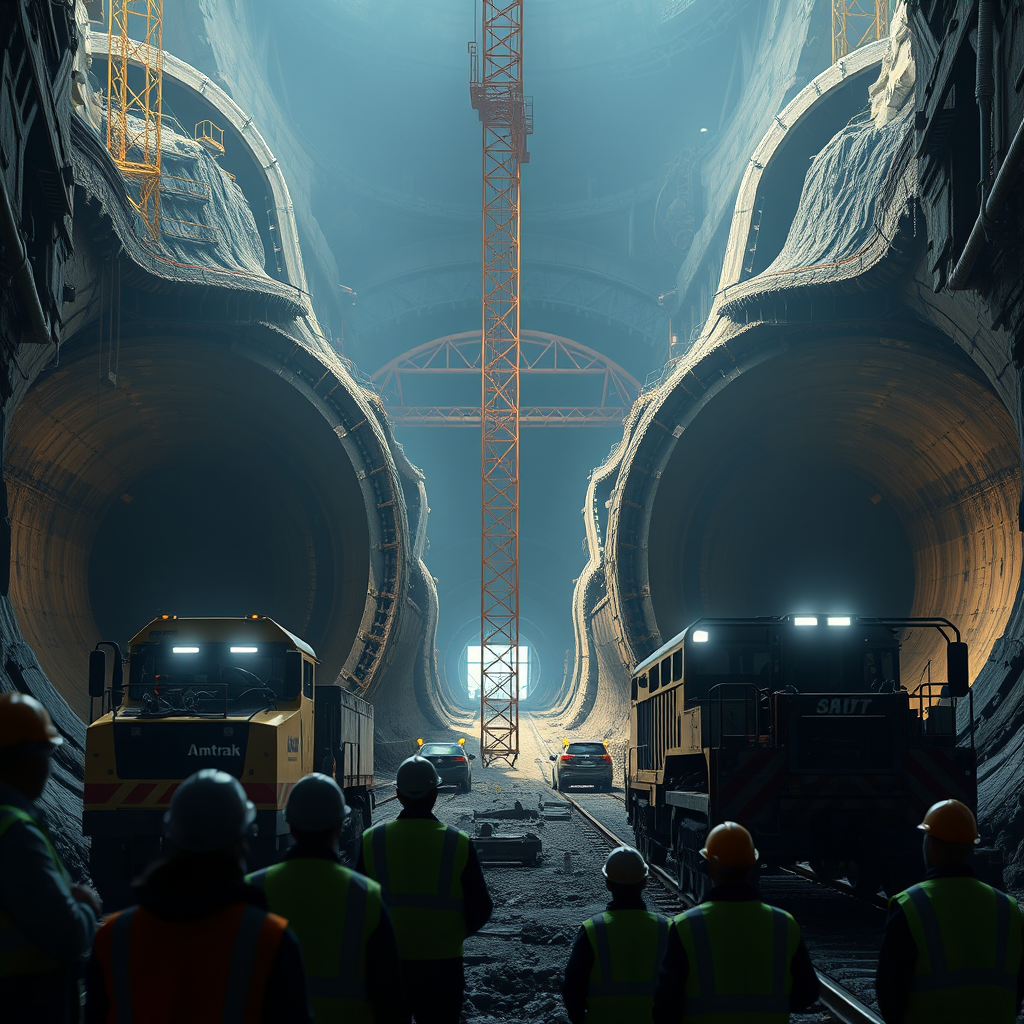

Operational Challenges in Rail

The rail division experienced substantial operational difficulties, reflected in a significant reduction in volumes. Volumes transported by the rail division decreased by 18.4% to 153.6 million tons. This decline was attributed to several factors, including infrastructure constraints, cable theft, and the unavailability of Transnet locomotive fleets. The Ports and Pipelines divisions also faced challenges. The Ports division handled 232.8 million tons, a decrease from the previous year’s 237.9 million tons, while the Pipelines division saw a 4.1% decrease in volumes, transporting 14.2 billion liters of fuel.

Strategic Initiatives and Restructuring

Transnet outlined several strategic initiatives aimed at improving operational efficiency and financial performance. These included efforts to address infrastructure maintenance backlogs, enhance security measures to combat cable theft, and optimize the utilization of its rolling stock. The company is also implementing a restructuring plan to streamline operations and reduce costs. The plan involves measures to improve asset management and focus on core business activities. Capital expenditure for the year was R14.7 billion. You might be interested in:

Outlook and Future Plans

Transnet acknowledged the challenging environment and outlined its plans for the future. The company intends to focus on improving operational performance, implementing its strategic initiatives, and strengthening its financial position. Key priorities include addressing infrastructure bottlenecks, securing its assets, and optimizing its workforce. The company plans to continue investing in its core operations to support economic growth and improve its service delivery.

Conclusion

Transnet’s financial results for the year ending March 31, 2024, revealed substantial challenges, particularly in its rail division. Despite a decline in revenue and profitability, the company is implementing strategic initiatives and a restructuring plan to improve operational efficiency and secure its financial future.

Company Summary

Transnet SOC Ltd.: A state-owned freight and logistics company in South Africa, responsible for operating ports, rail, and pipelines.

“`